The World Economic Forum (WEF), aka Mother-WEFers, are pushing governments around the world to get rid of cash and implement payment only by credit or debit card instead.

Optus recently demonstrated to over 10 million Australians how dangerous it is to rely on digital money in any way, shape or form when their network went down for over 15 hours due to technical difficulties. During the outage people were unable to get cash out of ATM machines or pay for purchases in businesses.

Emergency services were severely impacted. Yet, all Optus could tell us was to use our phones to call for help. Perhaps they didn’t realize how utterly stupid their advice was. Without a phone system, no one could call anyone.

Paying by card has become popular these days, because it is so convenient. But we all need to consider the benefits and drawbacks of this, as there are significant dangers involved.

We can stop this attack on our rights and freedoms by insisting on using cash when we go shopping.

But what do you do when a business refuses to take cash and insists that you only pay by card?

Businesses in Australia are not legally required to accept cash payments. They are free to choose which payment types they accept, and they can specify the terms and conditions that they will supply goods and services, including whether they will accept cash payment.

However, consumers must be made aware of these terms and conditions before they make a purchase. Businesses should be clear and upfront about the types of payments they accept and the total minimum price payable for their goods and services.

If a business refuses to allow you to pay with cash, this does not give you the right to walk out of their business with the goods you wished to purchase. That is theft.

If you see a sign at a business saying they do not accept cash, the best policy is to refuse to shop there. Walk on by. There are plenty of other places to buy the same thing for cash, and cheaper too because you won’t be forced to pay a card processing fee.

For more information, refer to the Currency (Restrictions on the Use of Cash) Act 2019. The act imposes criminal offenses if an entity makes or accepts cash payments in circumstances that breach the restrictions. The act also sets out rules for what happens when an entity that is not a legal person commits the offenses.

The Commonwealth of Australia Constitution Act 1901 Section 115 also decrees: A State shall not coin money, nor make anything but gold and silver coin a legal tender in payment of debts.

In other words, all government entities and businesses must deal only in gold and silver legal tender.

What are the drawbacks to using only cards to pay for everything?

Using only cards to pay for everything can offer convenience and advantages, but it also comes with several drawbacks that individuals should consider:

- Debt Accumulation: One of the most significant drawbacks of relying solely on cards is the potential to accumulate debt. Credit cards, in particular, allow you to spend money you don’t have, leading to high-interest charges and debt if you don’t pay the balance in full each month.

- Interest Charges: If you carry a balance on your credit card, you’ll incur interest charges, which can significantly increase the cost of your purchases over time.

- Overspending: Cards can make it easier to overspend, as the physical act of handing over cash is absent. The convenience of card payments can lead to impulsive purchases and a lack of awareness of how much you’re spending.

- Fees: Some credit cards have annual fees, foreign transaction fees, and other charges that can add to the cost of using cards for payments.

- Privacy Concerns: Card transactions create a digital trail of your spending habits, which some individuals may consider an invasion of their privacy. Your purchase history can be tracked and analyzed by card issuers and merchants.

- Merchant Acceptance: While card payments are widely accepted, there are still places, especially in remote or cash-only establishments, where card payments may not be an option.

- Technology Issues: Card payments rely on technology, including card readers, internet connections, and the security of the payment system. Technical glitches or security breaches can disrupt transactions. We have already seen ATM’s go offline, which has denied people access to their money.

- Dependency on Credit: Relying solely on cards can lead to a dependency on credit, which may affect your ability to access loans or mortgages in the future if you have high credit card balances.

- Loss or Theft: If your card is lost or stolen, there’s a risk of unauthorized transactions. While most card issuers offer fraud protection, you may still need to deal with the inconvenience of reporting and resolving fraudulent charges.

- Record-Keeping Challenges: With card payments, it’s essential to maintain careful records of your transactions, as it can be easy to lose track of expenses without the physical presence of cash.

- Financial Discipline: Using cards exclusively requires a high level of financial discipline to manage spending and avoid accumulating debt. Some people may find it more challenging to control their spending when using cards.

- The Ability for the Government to control your spending: If the government pushes through with its WEF-sponsored idea of enforcing a digital ID on all Australians, they will be able to monitor and even deny you the right to buy whatever you want. China is already doing this. So, we need to be very careful and make sure that government never gets the power to control our money.

The biggest drawback to using cards is the ease it offers governments to control how we spend our money.

We can see the danger when we look at China. Every aspect of their people’s lives is now controlled by the government, which monitors their citizens through an extensive network of facial recognition cameras, coupled with other digital technology that includes the ability to limit or even stop people purchasing anything with a card if they displace their dictatorial government.

Imagine not being able to get on a bus or train, or even buy food because the government decides you are a danger and it cuts off your access to money through a card.

If we lose our cash, as the banks and government of Australia are attempting to do today, we will end up losing all our rights and freedoms. The government is already pushing company directors to get a Digital ID. That is the first step in imposing total control over everyone. Once company directors all comply, the government will expand the demand to all Australians without exception.

We cannot allow this to happen. The only way we can stop their plans to impose total tyranny on us is to insist on using cash wherever we go.

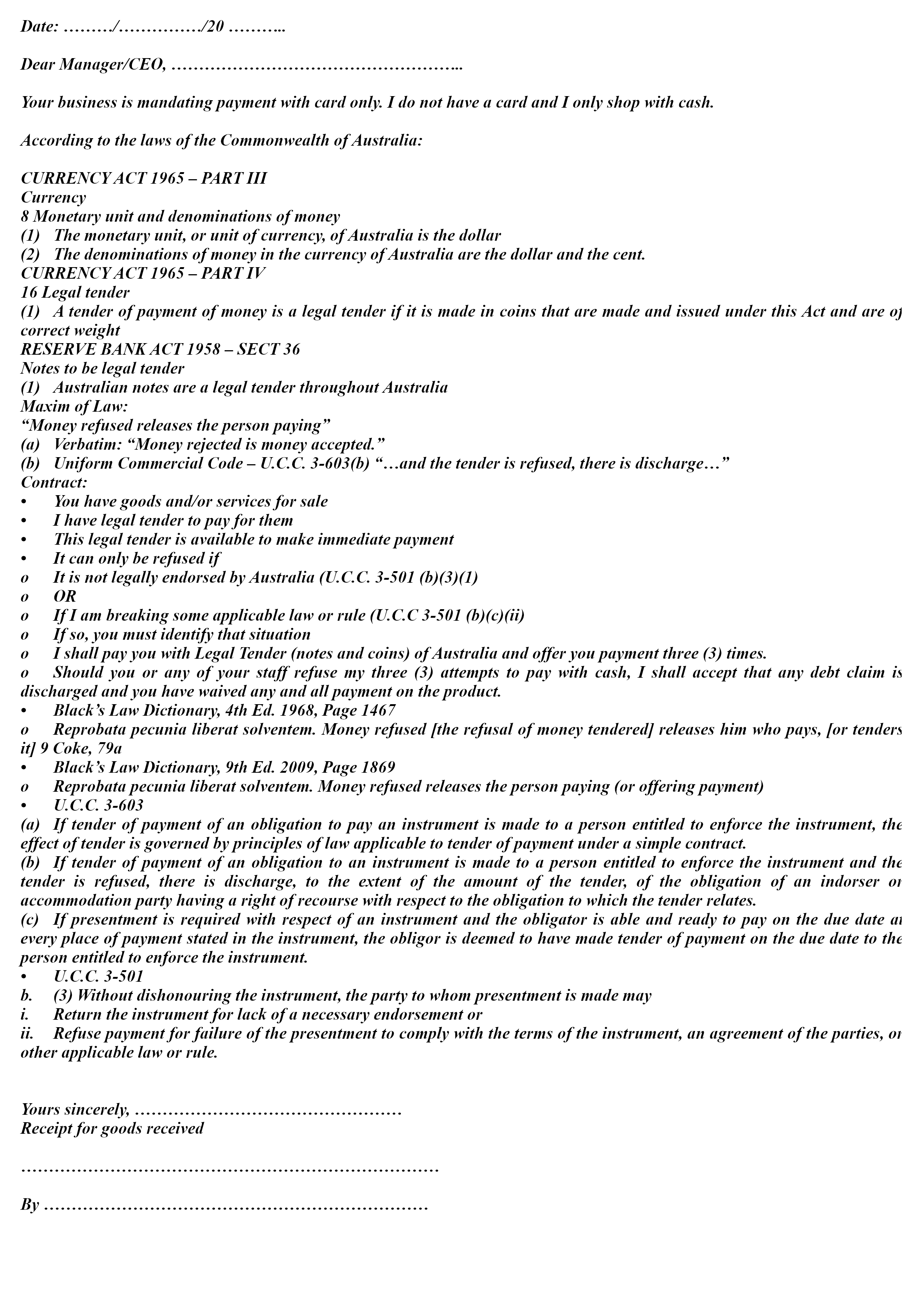

The image below is also available for download at the bottom of this article, so that you can print it out and give it to the business owner or manager to inform them that they are breaking the law when they refuse cash.

Document to inform a business:

What are the Advantages of using cash?

It’s often advisable to use a combination of payment methods that suits your financial goals and lifestyle. For example, using cash for budgeted expenses and reserving credit cards for emergencies or for earning rewards can help strike a balance between convenience and financial responsibility.

Using cash keeps your spending private so that the government cannot snoop on you, or even punish you if it doesn’t like the way you behave.

Consider these reasons for using cash:

- Budget Control: Using cash can help individuals stick to their budget more effectively. When you have a set amount of physical cash, it’s easier to see and feel how much money you’re spending, making it less likely for you to overspend.

- Privacy: Cash transactions are generally more private. When you pay with cash, there’s no electronic trail of your purchases, which can be appealing to those who value their privacy and want to keep their spending habits confidential.

- Avoiding Debt: Paying with cash can help you avoid accumulating credit card debt. Credit cards can encourage overspending if not managed properly, as it’s easy to defer the consequences of spending until the end of the billing cycle.

- No Fees or Interest: With cash, you don’t have to worry about interest rates or fees associated with credit card transactions. Credit cards often charge interest on unpaid balances and may have annual fees.

- No Risk of Fraud: Cash transactions are immune to the risk of credit card fraud, where your card information can be stolen and used without your consent. Cash transactions involve no personal information exchange.

- Universal Acceptance: Cash is universally accepted, making it a reliable form of payment, especially in areas where card payments may not be feasible or accepted.

- No Need for Technology: Cash doesn’t require technology or a stable internet connection, which can be advantageous in situations where electronic payment methods may not be available.

- Avoid Overspending: Some people find that physically handing over cash makes them more aware of their spending, preventing impulse purchases.

What to do if a business refuses to accept cash payment?

The law is very clear about what cash is.

Did you know that businesses must display a notice that the public can easily see that they only accept payment by card. If a business fails to display the notice, they can face legal penalties.

Section 115 of our Constitution states that our cash can only be gold or silver, but subsequent laws have been passed to allow paper money to be used as well. However, strictly speaking, those later laws are illegal as they contradict the Constitution and therefore, they are null and void (see also Constitution Section 109).

Our Constitution Section 115 states: A State shall not coin money, nor make anything but gold and silver coin a legal tender in payment of debts.

It is your right to insist on paying by cash. If a business refuses to accept payment in cash, do not just walk away. Tell the staff why they will not see your money, and then walk away.

Download and print out this document. Carry it with you at all times. Hand it to the manager of any business that refuses cash and ask them to sign it to be used as evidence.